Publication of sustainability information

Summary

FrenchFood Capital, a specialized management company in unlisted investment in the agri-food sector, is convinced that integrating Environmental, Social, and Governance (ESG) issues contributes to value creation, better risk management, and the sustainability of the development of supported companies.

Furthermore, in the food sector, ESG issues are present and critical at all stages of the food chain, from production to consumption, including processing, sourcing, and distribution.

The commitment to food that creates value for people, those who produce it (employees, suppliers, farmers), and those who consume it (eating better for everyone), for the environment, and territories becomes a sectoral prerequisite under the pressure of consumers’ increasingly high expectations.

ESG issues are therefore at the heart of the food issue.

The team therefore apprehends ESG as:

- a risk mapping tool,

- an integrated reporting tool for the overall value of the company,

- a tool for understanding the level of action and impact of the company in order to build the Impact Business Plan that will guide the impact ambition supported by the Fund.

The team has put in place a specific sectoral framework structured around the following 6 themes:

- Environment

- Social

- Governance

- Consumers

- Supply chain

- Territories

This framework structures the ESG and impact approach of the Funds managed by the Management Company, which is deployed throughout the investment lifecycle.

The FrenchFood Positive Impact Fund has defined a sustainable investment objective within the meaning of Article 9 SFDR: to accelerate food transition on environmental and social pillars in particular but also health and economic ones.

In addition to the ESG foundation, it will define with each of its investments an Impact Business Plan including at least one quantified impact objective on the environmental pillar and one on the social pillar. Achieving this impact business plan at the end of the investment period will measure the achievement of the sustainable investment objective of the FrenchFood Positive Impact Fund.

The environmental pillar will include at least one carbon emissions reduction objective according to a decarbonization trajectory defined for the investment period.

The FrenchFood Positive Impact Fund will primarily invest through equity stakes in small and medium-sized companies in the agri-food sector with enterprise values ranging from 20 to 150 million Euros.

Integration of sustainability risks

In accordance with Regulation (EU) 2019/2088 of the European Parliament and of the Council of 27 November 2019 on the publication of sustainability information in the financial services sector (the “SFDR Regulation”) supplemented by Regulation (EU) 2020/852 of the European Parliament and of the Council of 18 June 2020 on the establishment of a framework to facilitate sustainable investments (the “Taxonomy Regulation”), the Management Company is obliged to describe how sustainability risks are integrated into its investment decisions and the main negative impacts of its investments on sustainability factors.

A sustainability risk is an event or situation in the environmental, social, or governance (“ESG”) domain that, if it occurs, could have a significant, actual, or potential negative impact on the value of a Fund’s investment (the “Sustainability Risks”).

- Governance risks: defined as risks of portfolio value loss related to poor management or organizational practices that can harm the stability of the company. Governance risk analysis is systematically integrated into the ESG due diligence of each investment (ethical and business loyalty, ethics and respect for human rights, mapping of risks associated with activity, formalization of CSR strategy).

- Social risks: defined as risks of portfolio value loss related to social issues such as employee remuneration, working conditions, workplace safety, recruitment policies, diversity, and inclusion… Social risk analysis is systematically integrated into the ESG due diligence of each investment in terms of respect for fundamental rights as defined by the International Labor Organization conventions and indicators related to employment and employability, remuneration, well-being at work, diversity, and inclusion.

- Environmental risks: defined as risks of portfolio value loss related to environmental issues (consequences of climate change, scarcity of resources, pollution…). To reduce these risks, an analysis of the carbon impact and climate risks of companies is systematically carried out for each investment.

The Management Company has conducted an assessment of the likely impacts of Sustainability Risks on the Fund’s performance, and the main Sustainability Risks to which the Fund is exposed are as follows:

- the sustainability, performance, and sustainability commitment of the agricultural upstream;

- the impact of climate change on prices and the availability of raw materials;

- issues related to food safety and resulting crises; and

- the shortage of labor for certain positions with deemed difficult working conditions.

Sustainability Risks are integrated into the investment decisions of the Management Company and will be taken into account during the Fund’s investment process under the conditions described below, in accordance with the Management Company’s ESG policy:

- the Management Company takes into account Sustainability Risks for all investment opportunities of the Fund at each stage of the investment cycle. The Management Company has notably put in place internal policies ensuring the integration of ESG criteria within investment projects; and

- the investment team of the Management Company is required to fill in a sustainability risk mapping in the Final Investment Note which will present the investment opportunity to the Investment Committee. This mapping is based on the risk part of the ESG questionnaire completed at the time of due diligence. Such a process ensures that Sustainability Risks are identified and analyzed prior to any investment decision.

No significant detriment to the sustainable investment objective

All sustainable investments proposed must meet the minimum sustainability criteria ensuring that they do not significantly harm any sustainable investment objective, as determined through the ESG questionnaire prepared by the Management Company on 6 pillars (including environmental and social pillars). In this questionnaire, the indicators of Major Negative Impacts are integrated in addition to the indicators specific to the agri-food sector, ensuring that target investments do not undermine the Fund’s sustainable investment objective.

Throughout the investment cycle and during the entire life of the Fund, indicators concerning negative impacts are considered by the Management Company. During the investment and divestment phase, the use of the Management Company’s ESG questionnaire, which includes indicators concerning negative impacts, allows the evaluation of the presence or absence of Major Negative Impacts on sustainability.

The indicators will be considered as follows:

For environmental and other environmental-related indicators:

- level 1, 2, and 3 GHG emissions;

- carbon footprint;

- GHG intensity of Portfolio Companies;

- investment share in Portfolio Companies active in the fossil fuel sector;

- share of energy consumption and production of Portfolio Companies from non-renewable energy sources, compared to that from renewable energy sources, expressed as a percentage of the total energy sources;

- energy consumption in GWh per million euros of turnover of Portfolio Companies, by sector with a high climate impact;

- share of investments made in Portfolio Companies with sites/establishments located in or near biodiversity-sensitive areas, if the activities of these companies have a negative impact on these areas;

- tons of water discharges from Portfolio Companies, per million euros invested, on a weighted average basis; and

- tons of hazardous waste and radioactive waste produced by Portfolio Companies, per million euros invested, on a weighted average basis.

For social, personnel-related indicators, respect for human rights, and fight against corruption and acts of corruption:

- investment share in Portfolio Companies that have engaged in violations of the principles of the United Nations Global Compact or the OECD Guidelines for Multinational Enterprises;

- investment share in Portfolio Companies that do not have a policy to control compliance with the principles of the United Nations Global Compact or the OECD Guidelines for Multinational Enterprises, nor mechanisms for handling complaints or disputes to remedy such violations;

- unadjusted average gender pay gap within the management company;

- average gender ratio in governance bodies of Portfolio Companies, as a percentage of the total number of members; and

- share of investment in Portfolio Companies involved in the manufacturing or sale of controversial weapons

The Fund does not invest in companies that cause, contribute to, or are associated with violations of international norms and standards, particularly the principles of the United Nations Global Compact, International Labour Organization conventions, OECD Guidelines for Multinational Enterprises, and United Nations Guiding Principles on Business and Human Rights (UNGPs). These standards relate specifically to human rights, society, labor, and the environment.

Furthermore, the Management Company ensures that appropriate due diligence is conducted and that policies on human rights, equality, and anti-corruption are implemented across all investments made. The Management Company is committed to combating all forms of forced or compulsory labor and ensuring the effective abolition of child labor.

The Fund considers the Material Adverse Impacts of investment decisions on sustainability factors (i.e., environmental, social, and personnel issues, respect for human rights, anti-corruption, and acts of corruption) as part of its ESG policy.

The ESG policy ensures that the Fund’s investments do not significantly harm the Fund’s sustainable investment objective, notably by considering indicators concerning negative impacts. The Material Adverse Impacts of investment decisions on sustainability factors are mitigated by:

- the exclusion of companies with significantly negative impacts on one or more sustainability objectives, OECD and United Nations Guidelines for Multinational Enterprises, and ESG risk indicators defined by the Management Company within its due diligence framework;

- ESG actions with indicators that will be prioritized as part of the validated ESG roadmap in quarterly board meetings, and their results will also be tracked quarterly. Mitigating identified negative impacts in the due diligence conducted before investment will be the first level of short-term action in the ESG roadmap, which will be validated within the first six months following any investment; and

- the use of its influence as an investor to encourage companies to mitigate environmental and social risks relevant to their business. Quarterly board voting and monitoring are important elements of dialogue with the companies in which the Fund invests to promote the long-term sustainable value creation of these companies and mitigate negative sustainability impacts. The support provided by the Management Company to encourage knowledge sharing and develop sustainability expertise within the teams of Portfolio Companies is also a factor in making progress toward sustainable value creation and mitigating negative impacts.

Information on the Material Adverse Impacts on sustainability factors will be available in the Fund’s annual reports and online in the ESG and impact section of the Management Company’s website www.frenchfoodcapital.com.

Sustainable Investment Objective of the Financial Product

The sustainable investment objective of the FrenchFood Positive Impact Fund revolves around two main pillars, namely environmental sustainability (e.g., climate) and social sustainability (e.g., employment).

As such, the investments made by the Fund in Portfolio Companies will notably have the following objectives, thereby pursuing the Fund’s sustainable investment objective:

- Environmental:

- contribution to resource preservation

- climate change mitigation by reducing carbon footprint and eco-designing packaging

- reduction of food waste

- contribution to agricultural transition to more sustainable agriculture

- prevention and reduction of pollution

> the environmental objective will include, for each investment by FrenchFood Positive Impact, a decarbonization trajectory with a carbon intensity reduction target for the activity. To achieve this, a carbon footprint will be conducted at the start of the investment period to quantify the carbon impact of each company across the 3 scopes.

- Social:

- job creation

- skills development

- promotion of well-being at work, diversity, and gender equality

- contribution to the development of suppliers throughout the value chain

No benchmark has been designated for achieving the Fund’s sustainable investment objective.

Investment Strategy

The Fund’s investment strategy is to invest in the food sector. In the food sector, sustainability issues are present and critical at all stages of the food chain, from production to consumption, including processing, sourcing, and distribution.

The Fund’s investment strategy notably revolves around a sectoral ESG framework allowing for the identification of sustainability risks, major negative impacts, and the level of ESG action of the target company.

The Management Company has established its own sectoral ESG framework based on several external certifications, enriched with sectoral best practices and feedback on supported investments across six pillars (including environmental, social, and governance pillars). This framework is used in ESG due diligence and in monitoring the Fund’s investments. Within these six pillars, a filter identifies the standards to be met for the entire portfolio, particularly in the context of considering Material Adverse Impacts.

This framework structures the Management Company’s ESG approach throughout the investment lifecycle, including pre-analysis of sustainability risks through risk mapping, ESG due diligence highlighting the risks and strengths of the target company in relation to their business challenges and the expectations of their stakeholders, and annual monitoring of progress on key ESG indicators identified at the participation level as well as those consolidated at the portfolio level.

Moreover, the Management Company is a signatory of the UNPRI and commits to applying the principles for responsible investment established by the United Nations (www.unpri.org). The Management Company is also a signatory of the France Invest ESG Charter, the France Invest Gender Diversity Charter, and the SISTA Charter.

The Management Company has instituted a policy of excluding companies with significantly negative impacts on one or more sustainability objectives, OECD and United Nations Guidelines for Multinational Enterprises, and ESG risk indicators defined by the Management Company within its due diligence framework.

It has also defined a policy of excluding sectoral lines within the agri-food sector to achieve the Fund’s sustainable investment objective. These exclusion lines allow the Management Company to limit investment in certain sectors, companies, and underlying assets presenting specific ESG exposure risks, including:

- any product or activity prohibited by the laws or regulations of the country concerned or international conventions and agreements, or subject to a progressive ban or withdrawal at the international level;

- any company whose main activity consists of tobacco manufacturing or production;

- any company whose main activity consists of manufacturing or producing spirits;

- pesticides/herbicides subject to a progressive withdrawal or prohibition at the international level;

- unsustainable fishing methods (e.g., explosive fishing and drift net fishing in the marine environment using nets longer than 2.5 km);

- harmful forms of forced labor or exploitation. Forced labor refers to any work or service performed involuntarily, extorted from an individual under the threat of force or penalty as defined by International Labour Organization conventions.

- child forced labor. Child forced labor refers to the employment of children for economic exploitation, or that is likely to be hazardous to the child’s education, or to interfere with the child’s education, or to harm their health or physical, mental, spiritual, moral, or social development.

The ESG questionnaire completed during due diligence includes governance practices of Portfolio Companies.

These governance practices are reported annually in the Fund’s annual ESG report.

Moreover, the Fund’s use of its influence as an investor to encourage Portfolio Companies to mitigate relevant environmental and social risks enables the Management Company to assess the governance practices of Portfolio Companies. Quarterly board voting and monitoring are important elements of dialogue with Portfolio Companies to promote their long-term sustainable value creation and mitigate negative sustainability impacts. The support provided by the Management Company to encourage knowledge sharing and develop sustainability expertise within the teams of Portfolio Companies is also a factor in making progress toward sustainable value creation and mitigating negative impacts.

Investment Proportion

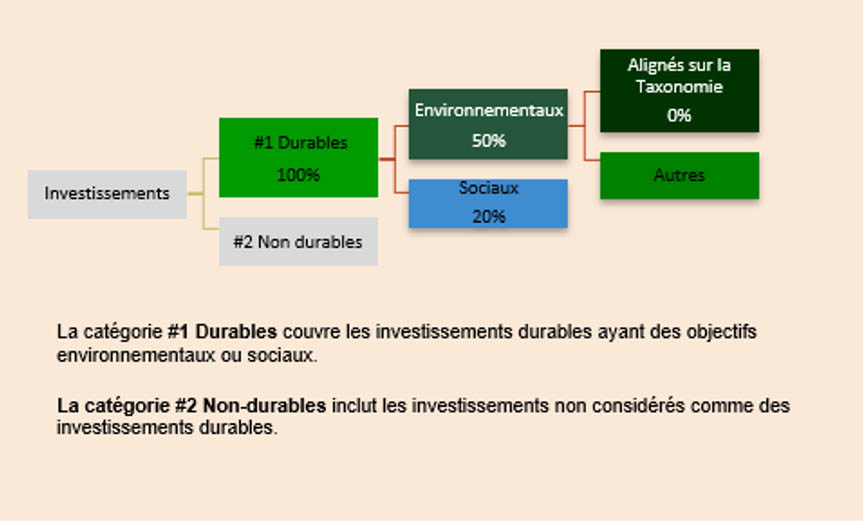

The Management Company aims for the investments of the FrenchFood Positive Impact Fund used to achieve the Fund’s sustainable investment objective to represent 100% of the amounts invested in Portfolio Companies.

The Fund does not aim to invest in sustainable investments with an environmental objective aligned with the Taxonomy Regulation.

Investment Objective Sustainability Check

For each Portfolio Company, the Management Company will identify ESG indicators (the “ESG Indicators”), which will be extracted from the sectorial framework established by the Management Company. Indeed, to support the ESG commitment of the Portfolio Companies, the Management Company has established a sectorial framework based on the frameworks of several external certifications, enriched with sectorial best practices. Based on these ESG Indicators, the Management Company will identify indicators to measure the impact of each investment in line with the company’s development strategy, challenges, and sector practices.

The methodology will be as follows:

- Preliminary Step (before Investment): The Management Company will ensure the integration of ESG criteria during the pre-investment phase, particularly in the analyses, due diligence, investment notes, offer letters, and review and negotiation of shareholders’ agreements.

- Step 1: For each Portfolio Company, the Management Company will, within the first 100 days following the investment decision – as part of the “100 Days Plan” (implementation plan for the strategy envisaged in the first 100 days following the acquisition of the Portfolio Company) – conduct an ESG diagnosis (including a carbon assessment) and identify the ESG and impact indicators specific to said Portfolio Company. This ESG diagnosis including the impact indicators will determine the baseline from which the impact ambition and the 5-year decarbonization trajectory will be defined.

- Step 2: Each Portfolio Company will define its 5-year “Impact Business Plan” consisting of 4 impact indicators (having a measurable and evaluable impact on a beneficiary stakeholder) including the carbon intensity of the activity with a 5-year ambition. This ambition will be justified in relation to sector challenges, market practices, and the Company’s baseline.

- Step 3: The Management Company will determine the respective weight of each impact objective.

Upon divestment, the Management Company will assess whether the impact objectives it set have been achieved and, taking into account the respective weight of each impact objective and their success rate, will determine an impact score (the “Impact Score”) out of 20.

Example: for a given Portfolio Company, the Management Company sets two impact objectives: (i) for 60% of the score, reduce greenhouse gas emissions by 20% (objective #1); and (ii) for 40% of the score, implement an annual training on workplace accident prevention (objective #2). If, at the time of divestment, greenhouse gas emissions have been reduced by 10% (objective #1 achieved to 50%) and an annual training on workplace accident prevention has been successfully implemented (objective #2 achieved to 100%), the Impact Score will be: (50%) x (60%) + (100%) x (40%) = 70%. Therefore, the Impact Score is 14/20.

[Note that this example is purely explanatory; in practice, (4) impact objectives will be identified for each Portfolio Company.]

The Management Company’s management team will be assisted by a leading ESG auditor in determining the Impact Score selected by the Management Company.

The Management Company will prepare an annual impact report (the “Annual Impact Report”) presenting the results obtained. This Annual Impact Report will be submitted for advisory review by the Impact Committee and will be communicated, accompanied by the Impact Committee’s opinion, to Investors within six (6) months from the closing of the accounts, starting from the first fiscal year.

The Impact Committee intervenes afterwards to:

- ensure the reliability of data collection;

- evaluate, once a year, the relevance of the monitored indicators and the levels achieved compared to the initial objectives; and

- recognize a right to make mistakes: reposition certain ESG Indicators or impact objectives, create new ones whose relevance is recognized or proposed by the Impact Committee.

Methods

The evaluation of the impact of portfolio companies is:

- Performed by the management of the portfolio company as part of monitoring the indicators selected within the validated Impact Business Plan at the company’s Boards and by the Fund’s Impact Committee;

- Certified by the portfolio company’s chartered accountant and an external third party specialized in decarbonization trajectory through an exit carbon assessment;

- Approved by the Fund’s Impact Committee.

Sources and Data Processing

Due to the scarcity of external data for private equity portfolio companies, the FrenchFood Positive Impact Fund uses a combination of the following data sources (for each Portfolio Company):

- Internal data – notably collected through questions asked during the due diligence process and post-investment engagement;

- Technical assessments conducted by third parties;

- Third-party data providers – selected on an individual basis for each company.

For some carbon footprint data, a proxy methodology may be used depending on the availability of data, especially for scope 3 data.

Limitations on Methods and Data

There are limitations regarding the availability and quality of data for private companies in the Private Equity segment due to their size, which must be taken into account by the Management Company when assessing the impact and ESG contribution of its investments. Information from third-party data providers is rarely available for privately held Portfolio Companies. In such cases, the Management Company will use a proxy methodology or rely on data from potential Portfolio Companies under review.

Due Diligence

The due diligence process throughout the investment lifecycle is described below:

Pre-investment

- ESG is integrated in the pre-analysis and due diligence phases via an analysis framework built from the FrenchFood Capital ESG framework. This analysis framework allows the Investment Team to identify the main ESG risk points and the company’s level of action upstream of the investment decision.

- In the pre-analysis phase, a mapping of sustainability risks and major negative impacts on the investment’s sustainable objective is established.

- In the due diligence phase, the ESG questionnaire filled out by the company allows for a quantitative assessment of risks and the company’s level of action by the management company. This diagnosis allows for the establishment of corrective ESG action plans to be implemented during the first 100 days.

Investment

- A detailed diagnosis of the company’s practices is provided by the Management Company, allowing management to identify their strengths and priority areas for improvement to build their roadmap.

- A carbon assessment (scopes 1, 2, and 3) is launched within the first 100 days to precisely quantify the company’s climate impact and build the decarbonization strategy over the 5 years of the investment period.

- The construction of an Impact Business Plan defining measurable and evaluable quantitative objectives over 5 years from this diagnosis is one of the objectives of the 100-day plan. The impact business plan will be submitted to the Impact Committee and then validated in quarterly boards and investment committees.

Portfolio Monitoring

- Support: setting up a collective toolbox in the form of a shared data room allowing everyone to benefit from the experience of other portfolio companies, organizing collective sessions for sharing experiences allowing the most advanced companies to share their actions and results with others.

- Monitoring progress of the Impact Business Plan in quarterly Boards. The annual achievement percentage of the Impact Business Plan ambition will be externally certified and submitted to the Impact Committee as well as to the strategic and advisory committee of the Fund. It will be validated in the Investment Committee.

- Annual ESG questionnaire sent to all portfolio companies to track progress on key ESG indicators as well as any new risks.

Exit

- Exit ESG questionnaire.

- Evaluation of the achievement of the portfolio’s Impact Business Plan ex-post from the baseline defined at the time of investment during the diagnosis. The percentage of achievement of the Impact Business Plan at exit will be externally certified and submitted to the Impact Committee as well as to the strategic and advisory committee of the Fund. It will be validated in Investment Committee.

- Valuation of overall performance (financial, ESG, and impact) in the divestment documents.

Each year, the percentage of achievement of the Impact Business Plan is certified by the company’s statutory auditor (CAC) and validated by the Impact Committee established by the Management Company.

Engagement Policies

The ESG questionnaire completed during due diligence incorporates the governance practices of Portfolio Companies.

These governance practices are subject to annual reporting within the framework of the Fund’s annual ESG report.

Furthermore, the Fund’s use of its influence as an investor to encourage Portfolio Companies to mitigate relevant environmental and social risks allows the Management Company to assess the governance practices of Portfolio Companies. Quarterly voting and monitoring are important elements of the dialogue with Portfolio Companies to promote the long-term sustainable value creation of the latter and mitigate negative impacts. The support provided by the Management Company to encourage knowledge sharing and expertise development in sustainability also constitutes a factor in progress toward sustainable value creation and the mitigation of negative impacts.

Achievement of Sustainable Investment Objective

The Fund uses, among others, the indicators listed below to assess the extent to which the sustainable investment objective is achieved:

- the percentage of the Fund invested in sustainable investments;

- the percentage of the Fund invested in sustainable investments with an environmental objective in economic activities that are not classified as environmentally sustainable according to the Taxonomy Regulation;

- the percentage of the Fund invested in sustainable investments with a social objective; and

the percentage of the Fund invested in companies with excluded activities in accordance with the exclusion list (as mentioned below).